Will competition be kept in neutral?

The public is increasingly embracing ride sharing. To date, debate has focussed on the implications for the taxi industry. However, ride sharing services, and the technological platforms underpinning them, have the potential to transform public transportation. In this bulletin we explore some coming policy challenges for government.

Most people would now be familiar with ride sharing services such as the smartphone app Uber. At first glance Uber, and its competitors, appear to be a simple variation on a taxi. Passengers select their exact pick-up location, get an indicative price and pick up time and then can track the vehicle once booked. This hides two real innovations. First, these platforms use sophisticated technology to match drivers and passengers which facilitates real time, direct bookings at low cost. Secondly, they use reputational reporting mechanisms to signal quality to passengers. This enables underutilised private cars to provide transport services.

Complements or conflicts?

While ride sharing services clearly compete against taxis their implications for public transport are less clear. Emerging evidence suggests that ride sharing may complement public transport by helping to link passengers to mass transit services. In Australia, most major cities rely heavily on trains to services commuter traffic. But passengers, not within walking distance of a station, typically combine their train journey with a bus trip, taxi trip or driving and parking at the station. These options vary in terms of expedience and cost: bus services can be cheap but infrequent, while taxis and parking are convenient but may be expensive.

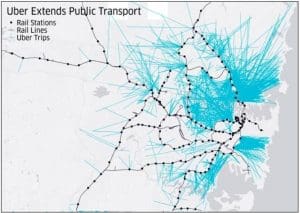

Ride-sharing could change this dynamic. A recent Choice investigation found that 9 out of 10 times, an UberX was cheaper than a taxi, on average by 40%.[i] Price falls of this magnitude could enable ride sharing to be a realistic alternative for connecting to transport hubs; and indeed there is some evidence to suggest this is happening. Figure 1 below suggests that a significant proportion of Uber routes in Sydney connect riders to train lines.

So far, so good, for train operations! But ride sharing could have a very different effect on bus patronage. The extent to which passengers substitute away from buses, in favour of ride sharing, will depend on whether the higher cost justifies the increased convenience/timeliness. In the last few years there appears to have been a slowdown in the growth of metropolitan bus patronage. For example in the 2016 financial year Melbourne bus patronage fell by 0.9% compared to an average growth rate of 2.6% pa over the period 2000-13[ii]. While the specific cause of this slowdown is unclear a further fall in ridesharing prices may exacerbate this trend.

Figure 1: Uber trips in Sydney from launch to 27/5/15

Source: Uber’s submission to the ACT Taxi Innovation Review

uberPOOL and LYFT Line

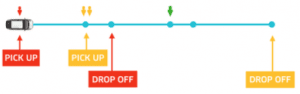

There is the potential for the cost of ride sharing to fall even further with the introduction of pooling services, such as uberPOOL and Lyft Line (now operating in various cities including Singapore, San Francisco and New York, but yet to arrive in Australia). Ride-pooling allows users to share a ride with another passenger and split the cost of the trip. In the case of uberPOOL, passengers book their trip on Uber as normal, but if they select uberPOOL the platform will look to match closely located passengers travelling along a similar route. This arrangement typically adds some time to the trip (on average less than 5 minutes) but reduces the cost for passengers. Uber has stated that uberPOOL now accounts for over 20% of all its rides globally[iii].

Dynamic routing may hold particular promise for passengers wishing to depart from, or arrive at, a common location, such as after disembarking a train. More people wanting to depart from the same place at the same time, improves the efficiency of the routes drivers may take. Hence, ride pooling services hold particular promise in densely populated areas where there are greater prospect for trip commonality.

Much like public transport these services also have the potential to result in more efficient use of vehicles and roads.

Figure 2: Example of an uberPOOL ride

Source: Uber (https://www.uber.com/en-SG/drive/singapore/resources/uberpool/)

Uber is now reported to be trialling a variation on UberPOOL called Uber Express POOL. In this service, the app generates a good meeting spot for all trip participants, and provides walking directions –potentially allowing the vehicle to smooth out the route between pick-ups and avoid busy spots. In the San Francisco trial, this brought the cost of an Uber below a bus fare.[iv]

Binning the bus timetable?

These developments have the potential to represent both a risk and opportunity for traditional bus services. While bus services may face future competition the technology underpinning ride pooling could help reform bus service provision.

On-demand buses are one such possibility. The key feature being flexibility — where the timetable, routes, and even stops can vary depending on demand. The Australian state of NSW is taking up the challenge and has just recently begun trialling select on-demand bus services in Sydney. Here the scope of on-demand services will be restricted to a particular zone, corridor or fixed destination or origin point such as a hospital or train station.

On-demand bus services can increase the efficiency of public transport. However, to be effective, three things are required:

- access to technology that can dispatch vehicles efficiently;

- potential passengers in close vicinity (density), to increase the likelihood of direct routes; and

- suppliers with the ability and incentive to respond to demand.

On the third point, existing ride sharing platforms tap into private vehicles and drivers with time to spare. If suppliers cannot (due to a lack of vehicles) or will not (due to insufficient price incentive) respond to demand, even access to technology and sufficient demand will not lead to better public transport.

How can governments facilitate competition?

Whenever the prospect of competition emerges in a previously constrained market, existing policies and regulations come under pressure. This has already occurred in the taxi market. However, our view is that the regulatory changes so far are likely to represent only the beginning of ridesharing’s market disruption.

Many, if not most, public transport services are subsidised. This is typically aimed at either increasing access to transport for disadvantaged members of society and/or reducing congestion and pollution. However, in a competitive market, subsidising one provider but not another, will distort market outcomes and potentially stifle competition altogether. And there is no better way to encourage providers to reduce costs, improve their services and innovate than competition. Ideally, we would preserve competitive neutrality in the early phases of the emergence of on-demand services.

But what does preserving competitive neutrality mean in practice?

First, the most efficient service might not come from an existing bus provider. On demand services involve the provision of transportation services and an intermediary dispatch/booking service which links passengers to the providers. While existing bus providers can procure the technology required to provide the latter, this could result in wasteful duplication of platforms. As an alternative governments could tender out the components of the services separately in order to take advantage of existing platforms and expertise in passenger matching.

Secondly, governments might need to change how they support and procure public transport; from competition “for the market” (via tendered bus contracts) to enabling competition “in the market”. It does not require a big stretch of imagination to see how on-demand buses and ridesharing services may end up competing for passengers. However, the way governments support and provide public transport will have a direct impact on the ability of rideshare services to compete.

For example, instead of subsidising uncommercial routes, to deliver societal goals, governments could introduce:

- vouchers for certain passengers who may be more costly to service (i.e. disabled passengers) and/or

- subsidise rides taken by certain passengers or in certain regions (rather than specific providers).

The effect of this would be that even on uncommercial routes, providers can compete on their merits and consumers can choose between providers.

We understand the majority of the NSW trial on demand bus services will be running by January 2018. It is a bold first step towards a change in the way public transport operates. But given the disruptions likely to be around the corner a bigger shake-up of public transport policies is likely to be necessary. While this is challenging the benefits of getting this right are potentially enormous.

[i] https://www.choice.com.au/transport/cars/general/articles/uberx-vs-taxi-which-one-is-best. Uber fares can incur price surges in times of high demand for rides.

[ii] PTV 2016 network statistics and BITRE (2014) Long-term trends in urban public transport

[iii] As of June 2016 (source: https://www.uber.com/newsroom/upfront-fares-no-math-and-no-surprises/)

[iv] https://techcrunch.com/2017/11/10/uber-express-pool/DOWNLOAD FULL PUBLICATION