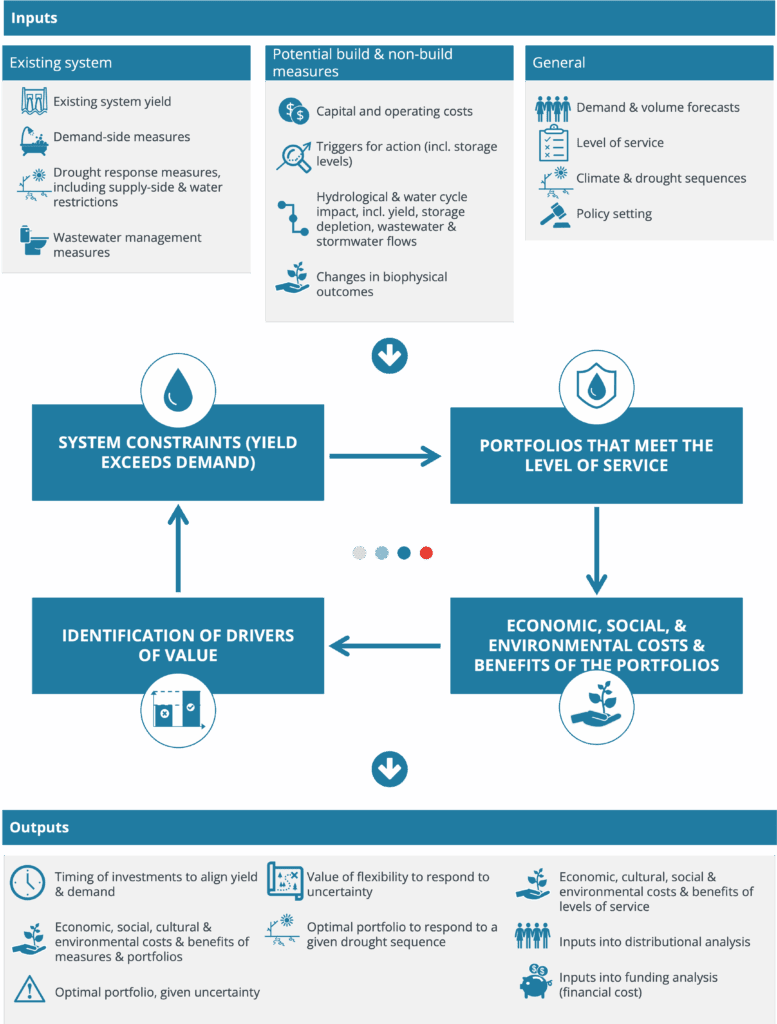

Given the increasingly interrelated nature of our water cycle, it’s no longer enough to separately assess our investments to manage long-term water security, short-term drought and wastewater and stormwater volumes.

Combining hydrological and economic analysis, our latest water model assesses the costs and benefits of alternative drought sequences to identify which supply or demand measure, or portfolio of measures, delivers the greatest value to the community, given uncertainty.

Our model helps decision makers answer questions like these, and more:

- Does desalination, water recycling, purified recycled water or water conservation deliver the greatest value for our community?

- What value can water restrictions provide in managing drought, given uncertainty around the severity of drought?

- What level of water security should we be delivering to our customers?

- How should prices be set to recover these costs?

With 20+ years of experience in evaluating the economic, cultural, social and environmental costs and benefits of water security measures, under uncertainty, our Hydroeconomic CBA model provides advanced risk and uncertainty analysis using real options analysis.

The model combines the flexibility to model multiple drought sequences at once – to answer what should we do given we don’t know whether we will go into extreme drought and in-depth analysis of a single drought sequence to answer – if we were in this drought sequence, what should we do?