We analysed a range of carbon internal pricing approaches against the Port’s business model and capital investment program.

These approaches included:

- Internal carbon price,

- Internal carbon fee,

- Implicit carbon price, and

- Internal emissions trading schemes.

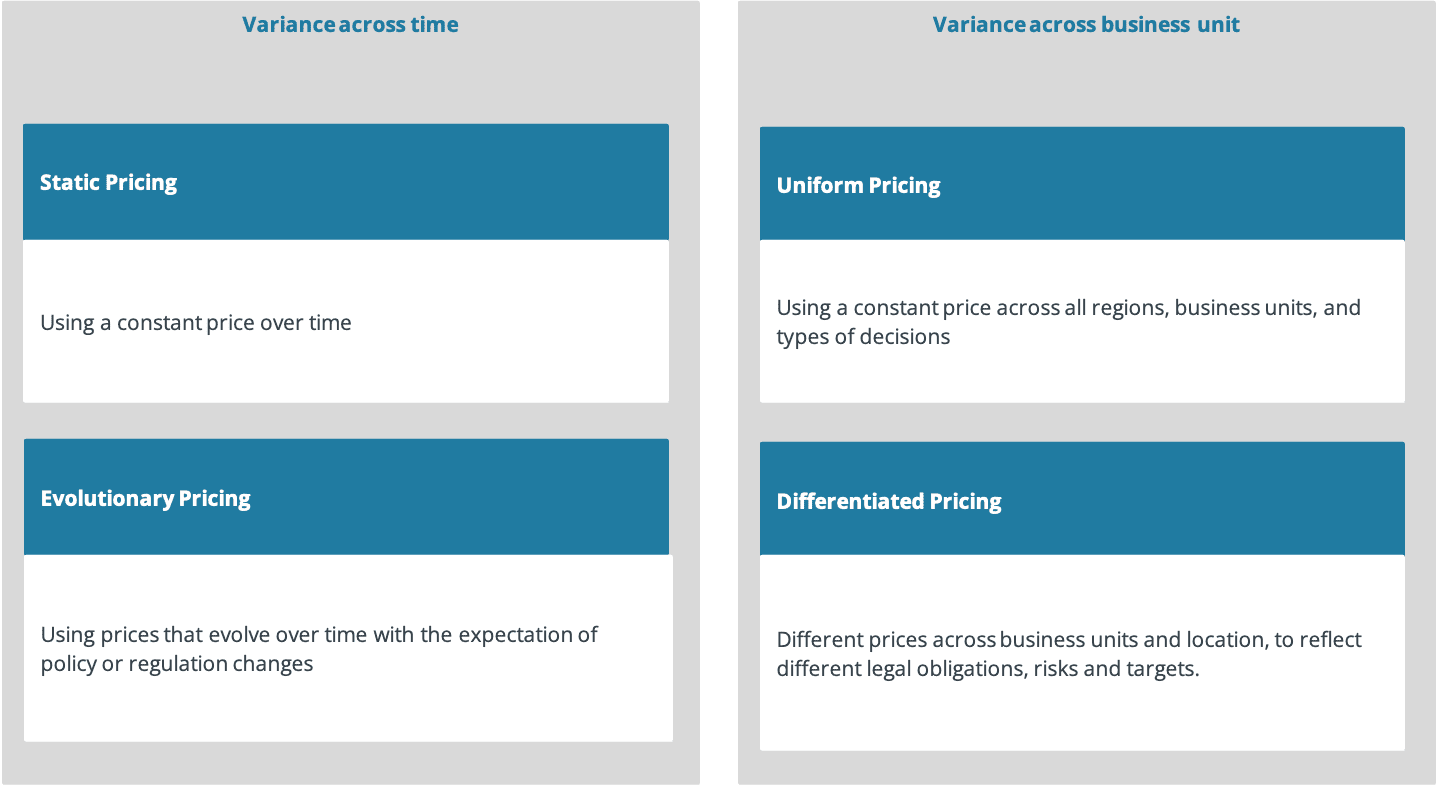

A key consideration in our analysis was that the largest potential impacts to the Port’s net zero emissions (scope 1 and 2) will come from the replacement of large, long-lived, capital investments. By analysing the implications of these features of the business, we developed options that allow for variances in internal carbon prices across both time and across business units (See the diagram to the left).

After selecting the best internal pricing approach in collaboration with the Port, we developed a method to assign a monetary value to the Port’s Greenhouse Gas Emissions (GHGs). We did this by looking at both market-based and social-cost carbon price benchmarks, as well as the carbon valuation approaches adopted by comparator organisations in the industry, and across Australian multinationals. The choice of valuation methodology was guided by the Port’s business objectives and its tolerance for cost and risk.

In developing our proposed carbon valuation methodology, we referred to Frontier Economics proprietary modelling: the ACCU/Safeguard Mechanism market model which can forecast ACCU prices to 2050. Our model runs different scenarios, providing maximum and minimum carbon prices for sensitivity analysis, and identifying different sources of abatement supporting the market. The model is based on granular, transparent inputs and assumptions.

View diagram (left)