At the International Institute of Communication’s Telecommunications and Media Forum, Sydney 2023 our Economist Warwick Davis joined a panel on competition issues in the sectors and commented on proposed merger reforms in Australia and the United States. He suggested that the Australian Competition and Consumer Commission (ACCC)’s proposed reforms for processes and legal tests for merger clearance will be contentious but seem more likely to produce economic benefits than the proposed changes to merger guidelines in the United States. This note explains the reasons for his view.

Merger reform proposals are a response to increasing market concentration

Competition authorities in many parts of the world are steering the debate on mergers towards sterner enforcement. The recently released details of proposed changes to merger enforcement in Australia and the United States show that competition authorities are on quite different paths to achieve that goal.

In Australia, details of the ACCC’s proposals for merger reform, as provided to Australian Treasury in March 2023, were recently released under Freedom of Information laws.[1]

The US Department of Justice and Federal Trade Commission (the Agencies) issued new draft merger Guidelines[2] for comment in July 2023. As in Australia, merger guidelines do not have the status of law, but they have been influential in US court merger proceedings.

The proposed changes are different, but they are both reactions to similar concerns – perceived harms from increasing market concentration that have not been prevented by merger laws and/or enforcement practices:

There is growing evidence to support the view that Australian markets are becoming more concentrated…It is important that Australia’s merger regime is effective in preventing increases in concentration before they occur.[3]

and:

[In the United States] Empirical research…has documented rising consolidation, declining competition, and a resulting assortment of economic ills and risks.[4]

Proposed changes to US Merger Guidelines renew emphasis on market concentration

The Agencies’ draft Guidelines have undergone a substantial change in form and substance from earlier versions.[5] The draft Guidelines show the Agencies’ desire to simplify the analysis of mergers that increase concentration or occur in concentrated markets, tied where possible to legal precedent. The FTC Chair has stated the draft Guidelines do not rely on “a formalistic set of theories” but “seek to understand the practical ways that firms compete, exert control, or block rivals”, and offer several ways to analyse transactions.[6]

The draft Guidelines have 13 specific guidelines that address analytical frameworks and specific challenges relating to serial acquisitions (creeping acquisitions in Australian parlance), buyer power in labour markets, platform markets and minority interests. This includes a return (in Guideline 1) to a stricter application of the ‘rebuttal presumption’ of market concentration that was first developed by the Supreme Court in 1961[7], and the introduction (in Guideline 6) of a rebuttable presumption in the case of vertical mergers, where a market share of more than 50% is involved.[8]

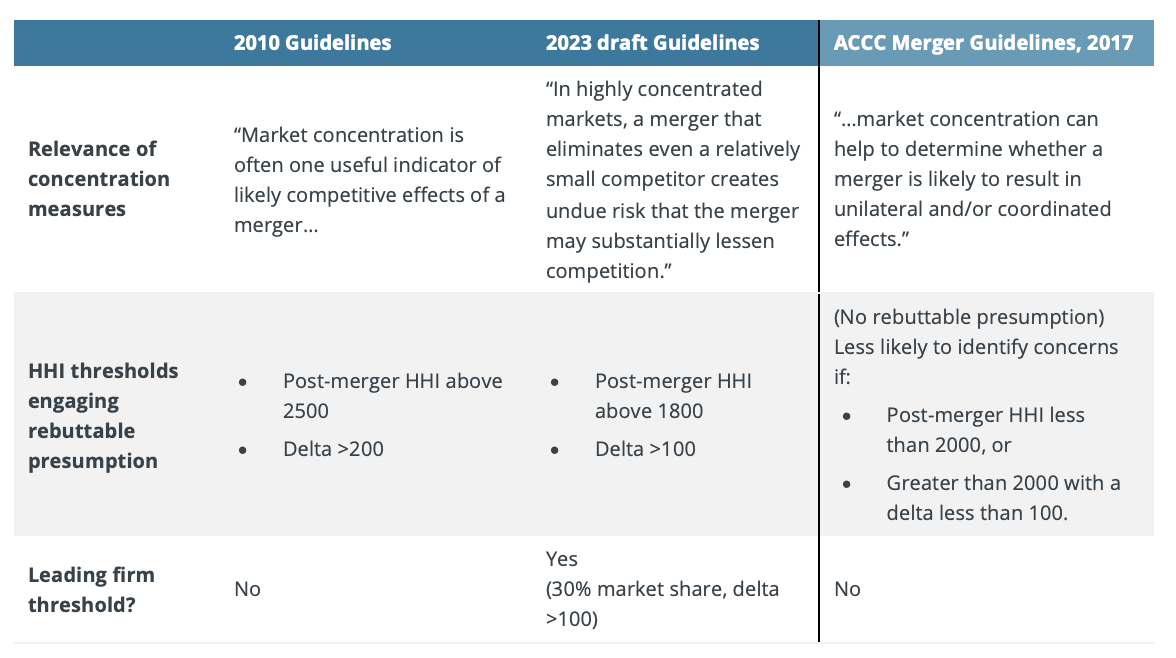

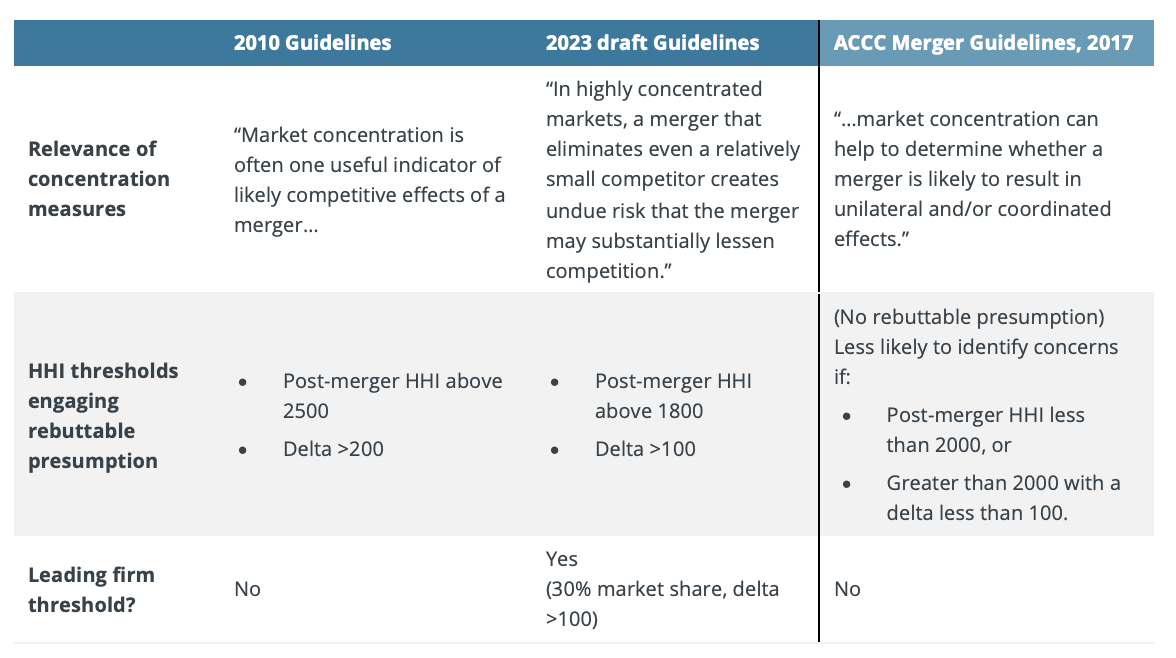

The changes from the 2010 version of the Guidelines on the significance of increasing market concentration are stark, as highlighted in Table 1. The thresholds at which the rebuttable presumption is engaged are reduced: in rough terms, a 6 to 5 merger of equally sized firms would now be subject to the rebuttable presumption while under the 2010 version it would not. For reference, the current ACCC Merger Guidelines approach (2017) is also highlighted, but these thresholds do not create rebuttable presumptions but instead provide an indication of the likelihood of concerns being raised.

Table 1: Changes in treatment of market concentration, US DOJ/FTC Merger Guidelines

Source: US Department of Justice and the Federal Trade Commission, Horizontal Merger Guidelines, August 19, 2010, draft Guidelines, p. 6, ACCC Merger Guidelines, 2017.

Similar problems, but different responses in merger reforms

The ACCC also has expressed concern with increasing market concentration. But the ACCC’s proposed reforms do not specifically focus on elevating market concentration to a more central role in merger analysis. Rather, the key elements of the ACCC’s reform proposals include:

- A formal merger clearance regime: large mergers could not go ahead unless a clearance was obtained from the ACCC or Tribunal.

- Changes to the merger clearance test: mergers can be blocked by the Federal Court under section 50 if they have the effect or likely effect of substantially lessening competition. The ACCC proposes that a merger would be cleared only if the ACCC (or Tribunal, on review) is satisfied that it is not likely to have the effect or likely effect of substantially lessening competition.

- Revisions to the section 50 merger factors: added factors include an emphasis on creeping acquisitions and entrenching existing market power.[9]

Concentrating on the right measure of competition?

We have previously suggested that the ACCC’s proposed changes to the process by which mergers are assessed, including formal merger clearance, are worthy of serious consideration. The changes would address defects in the current informal clearance regime and adjudication processes, particularly by empowering the ACCC to be the principal decision-maker and increasing the transparency of its decisions.

On the added measures, the proposed ACCC reforms are better for not aiming directly at market concentration, albeit that concentration will remain a significant element of merger investigations. This is for two reasons:

- Since the 1970s, economists have grown more sceptical of the causal connections between market concentration, competition, and economic performance. Concentration is only one factor in competitive health, and other market structures and conduct factors can be equally or more important.[10] For example, product differentiation, which is relevant to most mergers in Australia, highlights that the identity of competitors, and the similarity of their products, can have a greater influence on the competitive effects of mergers than aggregate concentration measures.

- So much emphasis on concentration places an undue reliance on the defined markets. The definition of markets is rarely clearcut, particularly where products are differentiated, and is inevitably a matter of judgement.

Striking the right balance on the cost of errors

The ACCC’s proposed changes to the section 50 legal test are likely to have a significant impact on the chance of contentious mergers being proposed and approved. Mergers that have uncertain effects would be more likely to be blocked than under the current system.

One framework through which to view the proposed changes is whether they minimise the total costs of decision-making errors:

- from not blocking anti-competitive mergers, and

- from blocking mergers that pose no threat to competition.

Compared with the existing legal test, the ACCC’s proposed changes will reduce errors of the first kind while increasing errors of the second kind. Both kinds of errors are relevant: while errors of the first kind harm consumers directly, blocking mergers that are pro-competitive will also harm consumers.[11] Undoubtedly, the balance of errors is complex to assess and we expect further debate over whether the proposed change restores or upsets the right balance.

Other proposals to structural merger factors seem more likely to be positive. The proposals focusing on accumulation of market power address long-standing concerns about creeping acquisitions but avoid placing increased weight on market concentration thresholds. This leaves more room for nuance in the merger analysis.

A step in the right direction

The ACCC’s proposals are a serious attempt to improve the processes and outcomes of merger reviews. Although the ACCC may be concerned about market concentration, it is helpful that the ACCC has not looked to tie its proposals directly to that concern – as is being pursued in the United States. While further debate on changes to the legal test is justified, we expect the ACCC’s proposed changes have reasonable prospects of improving competition and economic welfare.

[1] https://www.accc.gov.au/system/files/foi_disclosure_documents/ACCC%20FOI%20Request%20100067-2022-2023%20-%20Document%201_0.pdf (ACCC proposals)

[2] https://www.ftc.gov/news-events/news/press-releases/2023/07/ftc-doj-seek-comment-draft-merger-guidelines

[3] ACCC proposals, pp. 4-5.

[4] Remarks of FTC Chair Lina M. Khan, Economic Club of New York, July 24, 2023, p.3.

[5] The Agencies have amended the guidelines several times since the first guidelines were released in 1968, including in 1982, 1984, 1992, 1997, 2010, and 2020.

[6] Remarks of Chair Lina M. Khan, Economic Club of New York, July 24, 2023, p.2.

[7] United States v. Philadelphia Nat. Bank, 374 US 321, 363 (1961).

[8] Draft Guidelines, p. 17: “If the foreclosure share is above 50 percent, that factor alone is a sufficient basis to conclude that the effect of the merger may be to substantially lessen competition, subject to any rebuttal evidence.”

[9] ACCC proposals, p. 11.

[10] For example, in oligopoly settings, common market features such as cost asymmetry between firms or economies of scale can reverse the standard intuition that increasing concentration reduces economic performance.

[11] The ACCC suggests that the increased costs of errors will be borne by the merger parties rather than the public. That would only be true if the merger produced no efficiencies or did not otherwise benefit competition.

Frontier Economics Pty Ltd is a member of the Frontier Economics network, and is headquartered in Australia with a subsidiary company, Frontier Economics Pte Ltd in Singapore. Our fellow network member, Frontier Economics Ltd, is headquartered in the United Kingdom. The companies are independently owned, and legal commitments entered into by any one company do not impose any obligations on other companies in the network. All views expressed in this document are the views of Frontier Economics Pty Ltd.

Should economic regulators pursue other objectives, such as equity and social justice, in addition to efficiency? The theme of the 2023 ACCC/AER economic regulation conference was ‘Beyond efficiency?’

Speakers during the conference’s opening plenary session were invited to explore whether economic efficiency should continue to be the sole objective pursued by the economic regulatory frameworks in Australia. Or, alternatively, should the remit of regulators be expanded to include other objectives besides efficiency in the name of tackling the major challenges of our time, including: climate change, technological disruption and digitisation, the transformation of services and business models, and the growing inequity in access to services and outcomes?

Some of the speakers at this session, and some conference delegates, were firmly of the view that it is now time for regulators to balance the pursuit of efficiency with other objectives, such as equity and social justice.

This bulletin presents a summary of the address given by Dinesh Kumareswaran, Director of Frontier Economics, during this first plenary session. Dinesh argued that regulators should pursue one objective, and one objective alone: the promotion of economic efficiency.

What is economic efficiency?

A common misconception is that efficiency means producing widgets at the lowest possible cost. This is a very narrow and misguided view, and not at all how economists (should) think about economic efficiency.

When economists talk about efficiency, what they really mean is maximising total societal welfare. Total societal welfare is a very broad concept that encompasses economic prosperity, satisfaction, fulfilment and wellbeing.

So, when you hear economists mention efficiency, remember that what they are really referring to is, as the United States Declaration of Independence puts it, “the pursuit of Happiness.”[1]

Economic theory categorises efficiency into three dimensions:

- Allocative efficiency is when all resources in the economy are allocated to their best possible use. When this occurs, it is impossible to make someone better off without making someone else worse off.[2]

- Productive efficiency occurs when firms are producing a quantity and quality of output that maximises total societal welfare today at least cost.

- Dynamic efficiency occurs when firms are making investment choices that result in future production that maximises total societal welfare over the long run.

For more than 30 years, the regulatory frameworks that have been applied in Australia to natural monopoly industries have generally framed the objective of maximising total societal welfare in terms of promoting the long term interests of consumers with respect to price, quality and reliability of essential services.

During those three decades there has been consensus amongst Australian regulators that the most effective way to promote the long term interests of consumers is to set regulated prices or revenues in a way that incentivises allocative, productive and dynamic efficiency. As the Australian Competition Tribunal has observed:

…it is axiomatic in the principles of regulatory economics, that promoting allocative, productive and dynamic efficiency generally serves the long term interests of consumers.[3]

Why efficiency should remain the only economic regulation objective

A second common misconception is that economic efficiency is simply a means to an end. Invariably, those who espouse this view are unable to articulate clearly what the ‘end’ is.

When efficiency is understood properly to mean the maximisation of total societal welfare (happiness), it becomes clear that economic efficiency is in fact the end goal, rather than simply the vehicle to get there.

As explained below, there are at least three reasons why the promotion of economic efficiency should be the sole objective of regulators.

Reason 1: Clarity of purpose

One of the first lessons from public choice theory is that the Government should only intervene in markets if there is clear evidence of a market failure.

Evidence of market failure is not a sufficient condition for intervention—since regulation is almost never costless, and those costs may outweigh the benefits of regulation—but it is a necessary one.

Hence, if the Government is to intervene in a market through regulation, it must be crystal clear why regulation is required in the first place.

Economic regulation of natural monopolies was developed to address a very specific type of market failure. Given the lack of competitive constraint faced by such firms, if left unconstrained, natural monopolies would have a strong incentive to exercise their market power to set prices and output at a level that would diminish total societal welfare.

This reduction of total societal welfare—referred to in the economics literature as the deadweight loss from monopoly—is a form of economic inefficiency.

Economic regulation aims to protect against that loss of economic efficiency by trying to reproduce as closely as possible the efficient outcomes of a market that does not suffer from that market failure.

Remember, the golden rule is that the Government should intervene in markets only if there is a clear market failure. In other words, Government remedies should be targeted to clearly defined market failures, where it can be demonstrated that the Government intervention would result in a net benefit to society.

The market failure problem associated with natural monopolies has remained fundamentally unchanged over the past 30 years. If economic inefficiency is the problem, then the solution must be regulatory frameworks that are oriented towards promoting economic efficiency.

Of course, there are many different types of market failure that can occur, apart from the classic market failure associated with natural monopolies.[4] Economic regulation may have a legitimate role in addressing these different types of market failure. However, in every such case, the sole objective must be to maximise economic efficiency.

Reason 2: Effective institutions

There is overwhelming evidence that the most successful organisations (public and private) are those that single-mindedly pursue one objective, rather than multiple (often competing and unstated) objectives.

There are two reasons for this.

Firstly, all the resources of the organisation can be marshalled in the same direction, towards achieving a common purpose—rather than being diverted ineffectively in different directions.

Secondly, some objectives conflict with one another. In these circumstances, it may be impossible to achieve one objective without sacrificing another.

For example, the pursuit of equity and social justice (which some at the ACCC/AER regulation conference advocated for) typically involves redistributions from one group to another. This inevitably results in some groups being cross subsidised by others. Cross subsidies do not simply involve a transfer of welfare between groups; they also result in a deadweight loss to society (i.e., a reduction of total societal welfare).

Hence, the pursuit of equity and social justice is usually irreconcilable with the goal of promoting economic efficiency. The only way to do more of one is to do less of the other.

Therefore, regulatory agencies are likely to be more effective if they are focussed on a single objective (the promotion of economic efficiency), rather than pursuing efficiency and equity/social justice.

This does not mean that genuine social problems should be ignored. The point is that whether and how such problems should be addressed ought to be left to policymakers rather than regulators to determine.[5]

Reason 3: Sound governance

Ronald Reagan said the nine most terrifying words in the English language are: “I’m from the Government, and I’m here to help.”

A very close second must be: “I’m a regulator, and I have a great idea.”

Many regulators seem to have a penchant for ‘innovation’, new thinking and broadening the scope of their activities. Whilst improvements to the regulatory framework are sometimes necessary to respond to new challenges, it is vital that regulators resist the urge to go beyond their core role and step into the shoes of policymakers.

Good governance requires a bright line to be drawn between the roles of policymakers and regulators. This clear separation of powers is essential to:

- Reduce the risk of regulatory scope creep. As explained above, Government intervention in markets should be targeted at addressing well-defined market failures. Unchecked expansion of regulatory action is the antithesis of targeted intervention and is likely to result in more harm to society than good.

- Ensure accountability of decision-making. If the regulator is permitted to make policy, and policymakers are permitted to act as quasi-regulators (e.g., by exerting political influence on a supposedly independent regulator), then it becomes impossible to hold policymakers to account for poor policy outcomes, and equally impossible to hold regulators accountable for poor regulatory outcomes. A lack of accountability will inevitably lead to poor decision-making and worse outcomes for society.

If we as a society are unhappy with the direction of policy, we can remove the ultimate policymakers (i.e., elected representatives) via the democratic process. In principle, this limits the scope for bad policies. If regulators encroach on the domain of policymakers and we are dissatisfied with the policies they introduce, given that they are (at least in Australia) unelected officials, how do we vote them out?

The need for accountability and restraint on the power of decisionmakers is why most free, democratic societies such as Australia have a clear separation between the executive, legislative and judicial branches of Government.

If left unconstrained, governing institutions have a tendency to seek the accumulation of power and influence, often to the detriment, rather than service, of society. The solution to this problem is to separate the power of institutions so that they can each be held to account, while providing checks and balances on one another.

The desire for a clear separation of powers was the reason why, for example, three different market bodies—the Australian Energy Market Operator (system planner and operator), the Australian Energy Market Commission (rule maker), the Australian Energy Regulator (regulator)—were established to govern the National Electricity Market.

These three agencies were given separate (rather than overlapping) mandates, powers and obligations.

In principle, this is a good model for the governance of institutions. Because the regulator is not permitted to make the rules that it enforces:

- It cannot make changes to the regulatory framework on a whim. This produces more stable, predictable regulatory rules and outcomes; and

- It is easier to identify whether good/bad outcomes are due to the design of the rules or their implementation. This is an important discipline on the regulator’s decision-making.

Equally, because the rule maker is not responsible for enforcement, it is free to design and evaluate the rules dispassionately and on their merits.

Of course, under this model, regulators may have a legitimate role in identifying problems (market failures) and bringing those to the attention of policymakers. However, the relationship between the regulator and policymakers should remain at arm’s length, with the regulator simply raising awareness of an issue and then leaving it to policymakers to assess in an open and transparent way whether and how the issue should be addressed. In order to maintain the separation of roles, the regulator should not become an activist or advocate for policy change.

Conclusion

There is no doubt that regulators today must make decisions under considerable uncertainty about the future, in the face of new challenges such as climate change, technological disruption and digitisation, the transformation of services and business models, amongst others.

These challenges may require regulators to re-evaluate how best to achieve the most efficient outcomes for society as a whole and to adapt their frameworks accordingly. But there is no case for abandoning the efficiency objective, or adding new objectives that are unrelated to the problem that regulation is intended to solve. Doing so would likely produce worse outcomes for society at large, blur the distinct roles of policymakers and regulators, undermine clarity of purpose and reduce the accountability of decision-makers.

[1] This point was made by Dr Darryl Biggar during the closing session of the conference.

[2] This is a condition known as Pareto optimality in the economics literature.

[3] Applications by Public Interest Advocacy Centre Ltd and Ausgrid [2016] ACompT 1, para. 93.

[4] Other examples might include misleading and deceptive conduct arising from asymmetric information, negative externalities, coordination failures, and so on.

[5] The rule that the Government should intervene in markets if and only if there is a clear market failure applies just as much to policymakers as it does to regulators. This means that before intervening to address claimed equity or social justice problems, policymakers must (a) demonstrate convincingly, with evidence, that there is in fact a real market failure rather than an imagined one, (b) demonstrate that the intervention would be net beneficial to society as a whole and (c) be transparent with the public about what the equity and social justice objectives are and what Government actions are being taken to pursue those objectives. Policymakers should not intervene unless they are willing and able to do all these things.